- Pli Death Claim Procedure Template

- Pli Death Claim Procedure Sample

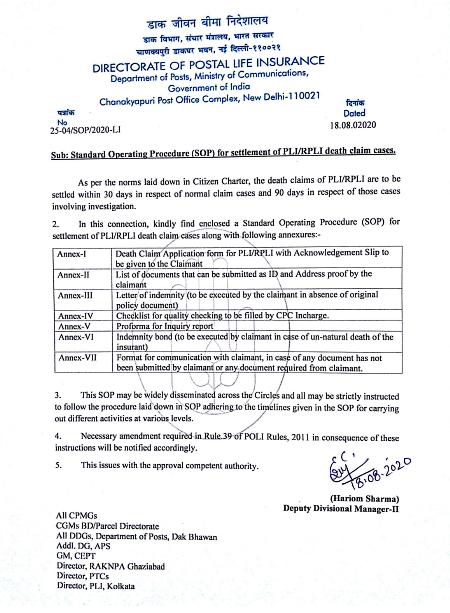

- Pli Death Claim Procedure Form

- Pli Death Claim Procedures

- Thus, even if the insured died in an accident, your ADD claim may be denied if the insurance company claims that the death is excluded from coverage for any of the reasons. To avoid a claim delay and a potential denial of your ADD benefits, work with an experienced life insurance attorney.

- The insurant is advised to nominate the person to whom the claim amount shall be payable in the event of his/her death. In the case of minor nominee, name and concern of the appointee (guardian) who may receive the said amount on behalf of the minor must be given.

- (a) Scope and purpose. In accordance with the authority of sections 503 and 505 of the Employee Retirement Income Security Act of 1974 (ERISA or the Act), 29 U.S.C. 1133, 1135, this section sets forth minimum requirements for employee benefit plan procedures pertaining to claims for benefits by participants and beneficiaries (hereinafter referred to as claimants).

- Sir i want take pli for my child, which pli is more beneficial my age 34 and my son age 3 year. Sum assured between 500000 to 1000000. Sir suggest some plan. InvestoBite Replied: 20:05:45 PLI Endowment Assurance (EA) Santosh is main plan under postal life insurance, you can go.

Death Claim Application Form 2. Original Policy Bond or Letter of Indemnity 3. Self Attested copy of Death Certificate (issued by Local Administration/register of local board/village panchayat/Medical Practitioner or Certificate from Doctor who last attended the insurer clearly mentioning reason of death.

Table of Contents

- Procedure involved in Death Claims in Life Insurance in India

- 2. Requirements /Documents

Procedure involved in Death Claims in Life Insurance in India

Death Claims in Life Insurance – Procedure Involved

The following are the general procedure involved in final settlement for death claims in India.

1. Intimation

First of all, the nominee or the assignee or deceased life assured close relative will have to send a letter intimating death to insurer. The letter of intimation of death should contain the following information:

- a statement that the life assured is dead;

- the date of death;

- the cause of death;

- the place of death;

- policy number and name of the life assured; and

- name and full address of the sender of intimation.

Click here to download a sample of Claim intimation form.

2. Requirements /Documents

Once a proper intimation is received, the status of the policy is verified and the requirements are called for. The following are the usual requirements:

1. Policy Bond

Original policy bond of the life insured has to be produced.

2. Deeds

Pli Death Claim Procedure Template

Deed of Assignments or Re-assignments executed separately, if any has to be produced.

3. Age Proof

Proof of age, if age is not already admitted.

4. Certificate of Death

Normally all major towns have some sort of civic administration such as village panchayats, municipalities which keep records of births and deaths. These bodies issue properly documented death certificates. The problem may however be experienced in some rare cases. In such cases, insurers call for some additional documents depending upon the merits of the cases. The forms are called claim forms and are either numbered or have descriptive names. These are:

Employer’s certificate: In case the deceased was an employee, the employer is in position to pass on the information whatever is available with them.

Cremation letter: It is usually given by 2 persons of repute residing in the neighborhood certifying that they knew the deceased and attended the cremation / burial.

Last Medical Attendant Report: As the name suggests, their report with other supportive evidence can serve the purpose of death certificate issued by Registry.

Click here to read how to obtain death certificate form

5. Claimant form

The claimant form has to be signed by the nominee / assignee or legal heirs and sent to the insurer.

6. Additional Report

Where the life assured has died an unnatural death such as by an accident, suicide or due to an unknown cause, the insurer will need special requirement depending upon the nature of the case, such as:

For DAB Cases: First Information Report (FIR) and Post Mortem Report (PMR) to prove accident.

In case of murder of the life assured: FIR and the report that a legal case was initiated against the accused. Settlement of claim many wait till court’s decision.

7. Proof of Title

The claim is payable to the Nominee or the Assignee as the case may be. In case, the life assured has died without making an assignment or a nomination, the insurer would require legal evidence of title (proof of ownership). The following certificates may be considered as proof as the claimant’s title

- Probate of the will of the deceased assured,

- Succession certificate obtained on the strength of the will.

- Letters of Administration.

+Schemes%3A+Whole+Life+(GRAMA+SURAKSHA).jpg)

8. Presumption of death

By Sections 107 and 108 of the Indian Evidence Act, death may be presumed if it is proved that the life assured has not been heard of for seven years by those who would naturally have heard of him if he had been alive. Insurer would require an order of the Court in this connection. The courts generally presume death to have taken place at the end of seven years from the date of appearance.

9. Missing policy

In case, the policy cannot be produced and there is no reason to suppose that it has been dealt with in anyway, company can make the payment on completion of an indemnity. It should be noted that non-production of the policy is not in itself sufficient ground for refusing payment. But insurer has every right to satisfy itself about the bonafides of the case and it is the duty of the claimant to satisfy the insurer in this regard.

10. Rival claimant

As per Section 39 of the Insurance Act, a nominee has the right to receive the amount under Death claim. Suppose, insurer receives a letter from a person other than the nominee, he is called the rival claimant. In such cases, insurer will inform the rival claimant that amount will be paid to the nominee unless they are prohibited by an order of the court. If no court’s injunction is received within a specified period of, (say) 15 years the insurer will pay the claim to the nominee.

11. Early Claims

If the claim has arisen within a year or two from the risk date or revival, investigations are done by the office on receipt of the claim forms. If the investigations reveal that there was no fraud and no material fact was concealed at the time of proposal, the insurer would issue the necessary discharge forms for completion.

12. Agent ‘s Confidential Report

Immediately after learning about the death of the assured, the insurer will ask his agent to make a thorough inquiries into the matter at once and to report fully on the form supplied to him. The confidential report is intended to provide a confirmation of the death of the assured, date of death and cause of death.

Click here to download a sample of Agent’s Confidential Report

3. Calculation of Claim amount

After having gone through all the documents mentioned above, if the claim is found correct and in order, the amount of claim to be paid is calculated. The calculation of claim amount is done exactly in the same manner as done under maturity claims, except that the amount of outstanding premiums for the current policy at the time of death is further deducted out of the claim amount.

4. Payment and Discharge

Finally, the insurer has to collect a completed and stamped discharge voucher from the nominee or assignee or legal heir of the deceased assured. Once the discharge voucher is received, the insurer shall proceed for payment of the claim. The claim amount to be paid is entered in the claim payment register and a cheque is sent to the claimant under registered cover.

POSTED BY ON March 11, 2019 COMMENTS (11)

It is very easy to buy life insurance. You just pay the premium, attach some documents, get your health check-up done and you will become a policyholder. Even nowadays it has become more convenient to buy, as most of them can be bought online.

So, at the time of buying it’s really the fast process but, have you thought that how will your family get the claim settled after your demise? What all will be the steps that they need to take to receive the claim amount? It is important to have life insurance for your family’s financial security against the risk of your death but what’s more important is, that eventually its benefits must reach the beneficiary.

In this article, we will guide you on what all steps your family members will need to take to get your life insurance sum assured amount so that you can inform them about all the procedures and documents required to get assured life insurance sum.

What is Life Insurance?

Lets first see what does life insurance means by definition. So, “Life insurance is a contract between an insurance policyholder and an insurer (insurance company), where the insurer promises to pay a designated beneficiary a sum of money in exchange for a premium, upon the death of an insured person.” It means the main purpose is to provide a sum of money to the designated beneficiary (a nominee or legal heirs). So, now let’s see what does your beneficiary need to do to get the claim settled.

Claim settlement Form:

Firstly your family member has to get a claim settlement form from the insurance company and fill all the details. Along with the form he/she needs to attach all the documents along with the form. The list of all the documents required is given below:

- Original Policy document

- In the form, it is asked whether a claimant is a nominee or not? If not then the claimant needs to prove that he is a legal heir of the deceased by submitting the “Will” or if there is no will then it has to be proven by Succession laws.

- If the claimant is a Nominee then Nominee ID proof establishing the relationship between nominee and person who died has to be provided.

- Notarized death certificate of the policyholder (deceased)

- In case the death happened in the hospital, document of hospital

- Copy of claimant’s current address proof

In case of Accidental Death along with the above documents following are to be attached:

- Hospital certificate

- Post-mortem Report

- FIR copy

- Final report of police

- Newspaper cutting if any

- Driving license of the person if the death happened while driving due to the accident

- In case of death outside India, was the deceased buried or cremated abroad? If yes, enclose a copy of the burial/ cremation permit.

It is very important to keep the acknowledgment slip mentioning all the documents which were submitted because it may be required for compliance of claim settlement.

Pli Death Claim Procedure Sample

Settlement of claim

As you now know how to claim, the next question will be how much time will it take to get the money? So, for this read the provisions on claim settlement provided by IRDAI.

Pli Death Claim Procedure Form

As per the regulation 8 of the IRDAI (Policy holder’s Interest) Regulations, 2002, the insurer(company) is obligated to settle a claim within 30 days of receipt of all necessary documents including extra documents sought by the insurer. If the claim requires further investigation, the insurer needs to complete its procedures within 6 months from receiving the written intimation of the claim.

List of top 5 insurance company with death claim settlement ratio for the last 5 years – Below given table shows the claim settlement ratio of insurance companies. It is based on the individual death claim number published every year by IRDAI in its Annual Report. LIC tops the list of death claim settlement ratio for the last 5 years.

To give you a clearer picture, I have attached the screenshot of top 5 insurance companies during individual death claim settlement within 30 days of intimation.

Where to go if there is a dispute between the claimant and the insurer?

In many cases, life insurance claims have been delayed or denied due to a lack of proper documentation. So, make sure that your claim should not be denied due to this. And even after this claim settlement is delayed then there is a special court called Ombudsman of IRDAI (is a special court) where all claim-related disputes are solved. So if the claimant feels that they are being cheated or the claim is rejected despite submitting all the required documents then the claimant can approach the Ombudsman of IRDAI.

Pli Death Claim Procedures

I hope now you are clear with the procedure to claim your settlement. Please feel free to comment about how fruitful this article was.